Buying an ATM vs. Free ATM Placement: A Business Owner's Guide

Introduction

Business owners today are always looking for smart ways to grow their revenue and enhance customer service. One often overlooked yet highly effective strategy is adding an ATM to your business location. But when it comes to making that move, you face an important decision: should you buy an ATM or join an ATM Placement Program?

This article helps break down both options so you can make an informed choice based on your business goals, budget, and capacity.

What is an ATM and Why Do Businesses Use It?

Basic Functions of an ATM

An ATM (Automated Teller Machine) allows customers to withdraw cash, check balances, and sometimes deposit funds without visiting a bank. These machines are a convenient addition to stores, restaurants, gas stations, hotels, and more.

Benefits of Having an ATM in Your Store

- Increases foot traffic

- Boosts impulse sales when people use cash

- Builds customer loyalty through added convenience

- Earns extra income from transaction fees

Typical ATM-Related Revenue Streams

When a customer uses the ATM, they often pay a small surcharge fee. If you own the ATM, you keep that fee. If you're part of an ATM Placement Program, you share that fee with the provider.

"Cash is still king." Despite digital payment trends, over $20 billion in cash is withdrawn from ATMs every month in the U.S.

What is an ATM Placement Program?

Full-Service ATM Management Explained

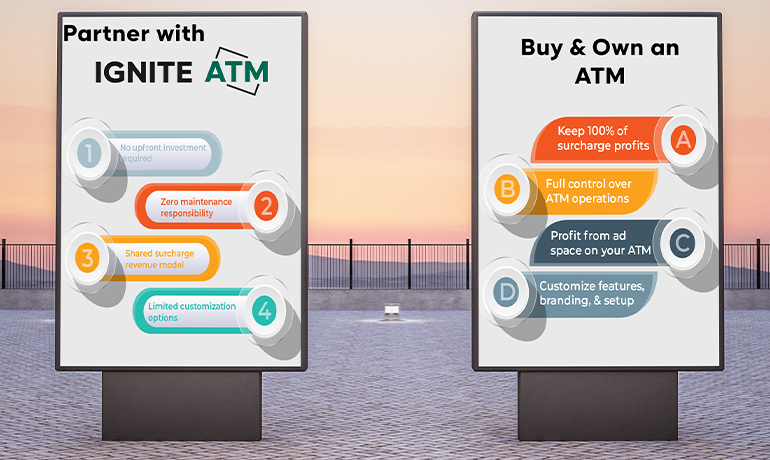

An ATM Placement Program is a partnership where a company like Ignite ATM installs and manages the ATM at your location. You don't buy the machine or pay for maintenance, installation, or cash vaulting. It's truly a turnkey solution.

What the Provider Handles (Installation to Maintenance)

- Purchasing the ATM

- Installing the ATM

- Managing cash delivery

- Handling repairs and maintenance

- Providing software updates and compliance

Profit Sharing and Passive Income

While you won't receive the full surcharge fee, you'll still earn a percentage of each transaction—all without investing money or time into the machine.

Buying an ATM vs ATM Placement Program – Pros and Cons

| Option | Pros | Cons |

|---|---|---|

| Buying an ATM |

|

|

| ATM Placement Program |

|

|

Key Factors Business Owners Should Consider

Available Capital and Willingness to Invest

- If you have the budget to invest and want to manage operations, buying may be right for you.

- If you want to avoid upfront costs and risks, a placement program is more practical.

Desire for Control vs. Convenience

- Do you want to be in charge of every detail?

- Or do you prefer to let experts handle everything?

Location Foot Traffic and Transaction Volume

- High-traffic areas may justify owning the ATM.

- For moderate to low volume, placement programs still generate revenue without expenses.

Ability to Handle Maintenance and Compliance

- Regulations can be complex. Placement programs ensure compliance and uptime, relieving you of stress.

Which Option is Right for Your Business?

Recap of Main Differences

- Buying an ATM gives you control and full profits, but comes with higher responsibilities.

- An ATM Placement Program offers low-risk passive income, with everything managed by your provider.

Recommendation Based on Business Goals

- For hands-off income and peace of mind, an ATM Placement Program is ideal.

- If you're hands-on and want full earnings, consider buying an ATM—just be prepared for the workload.

All with zero investment in many cases.